Difference Between Long And Short Call . Building on the insights from our “short calls vs long. long calls and short calls explained. One is bearish, and the other is bullish. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. Short puts profit in both neutral and bullish markets. short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. Long calls profit when the underlying stock, etf or index moves up significantly. in this guide, we’ll explore the differences between short call options and long call options. long calls and short calls are option contract strategies. With stocks, a long position means an investor has bought and owns shares of stock. An investor with a short position has sold shares but does not possess them yet.

from www.adigitalblogger.com

Short puts profit in both neutral and bullish markets. short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. in this guide, we’ll explore the differences between short call options and long call options. Long calls profit when the underlying stock, etf or index moves up significantly. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. An investor with a short position has sold shares but does not possess them yet. long calls and short calls are option contract strategies. Building on the insights from our “short calls vs long. long calls and short calls explained. With stocks, a long position means an investor has bought and owns shares of stock.

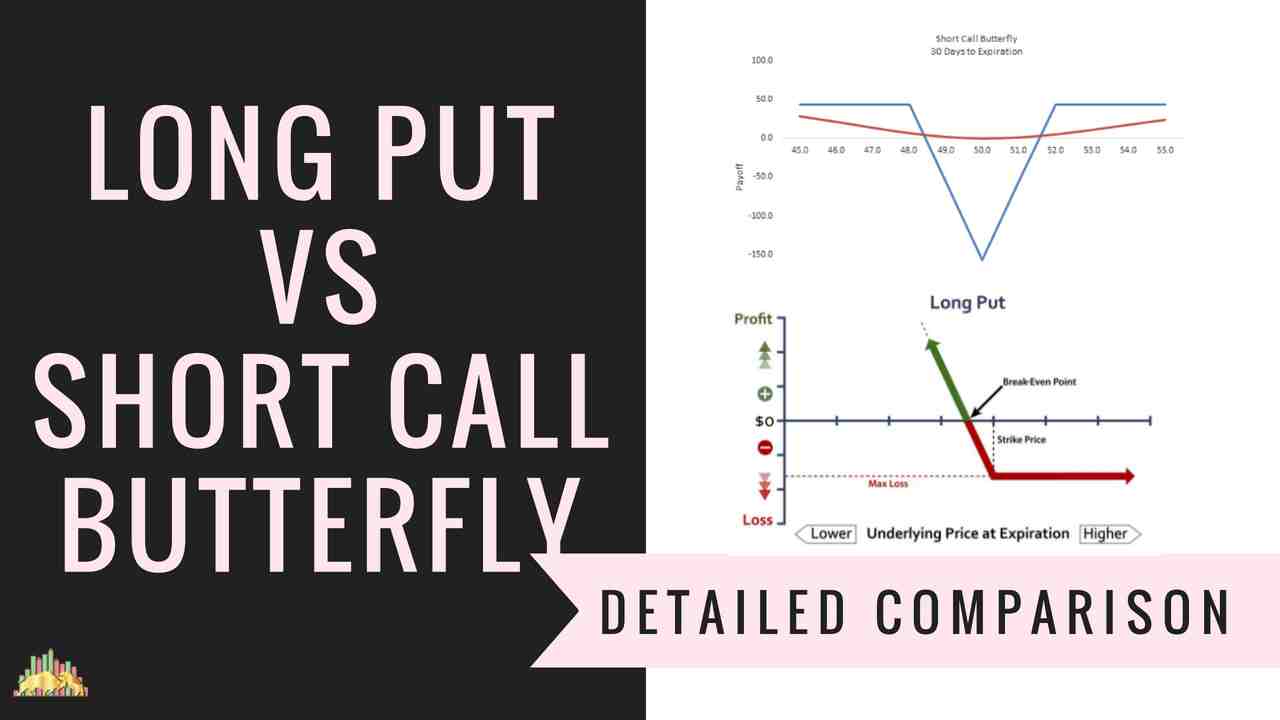

Long Put Vs Short Call Butterfly Option Trading Strategies Comparison

Difference Between Long And Short Call Short puts profit in both neutral and bullish markets. in this guide, we’ll explore the differences between short call options and long call options. One is bearish, and the other is bullish. Long calls profit when the underlying stock, etf or index moves up significantly. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. long calls and short calls explained. Short puts profit in both neutral and bullish markets. long calls and short calls are option contract strategies. short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. Building on the insights from our “short calls vs long. An investor with a short position has sold shares but does not possess them yet. With stocks, a long position means an investor has bought and owns shares of stock.

From www.projectfinance.com

Long Call vs Short Put Comparing Strategies W/ Visuals projectfinance Difference Between Long And Short Call Building on the insights from our “short calls vs long. One is bearish, and the other is bullish. Short puts profit in both neutral and bullish markets. An investor with a short position has sold shares but does not possess them yet. Long calls profit when the underlying stock, etf or index moves up significantly. long calls and short. Difference Between Long And Short Call.

From www.vrogue.co

What Is Difference Between Long Call Vs Short Call vrogue.co Difference Between Long And Short Call Long calls profit when the underlying stock, etf or index moves up significantly. in this guide, we’ll explore the differences between short call options and long call options. Building on the insights from our “short calls vs long. long calls and short calls explained. In the world of options trading, call options refer to the right to buy. Difference Between Long And Short Call.

From www.adigitalblogger.com

Long Put Vs Short Call Options Trading Strategies Comparison Difference Between Long And Short Call short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. Building on the insights from our “short calls vs long. long calls and short calls explained. An investor with a short position has sold shares but does not possess them yet. In the world of options trading,. Difference Between Long And Short Call.

From www.adigitalblogger.com

Long Put Vs Short Call Butterfly Option Trading Strategies Comparison Difference Between Long And Short Call An investor with a short position has sold shares but does not possess them yet. Short puts profit in both neutral and bullish markets. Long calls profit when the underlying stock, etf or index moves up significantly. With stocks, a long position means an investor has bought and owns shares of stock. short calls are a bearish options strategy. Difference Between Long And Short Call.

From www.youtube.com

3. Long Call Payoff and Short Call Trade YouTube Difference Between Long And Short Call short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. Building on the insights from our “short calls vs long. One is bearish, and the other is bullish. With stocks, a long position means an investor has bought and owns shares of stock. long calls and short. Difference Between Long And Short Call.

From libertex.com

Put vs Call Option Learn the Difference Difference Between Long And Short Call short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. Building on the insights from our “short calls vs long. With stocks, a long position means. Difference Between Long And Short Call.

From investinganswers.com

Call Option Example & Meaning InvestingAnswers Difference Between Long And Short Call In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. Building on the insights from our “short calls vs long. in this guide, we’ll explore the differences between short call options and long call options. short calls are a bearish options strategy used to profit from. Difference Between Long And Short Call.

From www.youtube.com

Long Call / Short Call options Trading Strategy YouTube Difference Between Long And Short Call In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. Long calls profit when the underlying stock, etf or index moves up significantly. Building on the. Difference Between Long And Short Call.

From www.projectfinance.com

Long Call vs Short Put Comparing Strategies W/ Visuals projectfinance Difference Between Long And Short Call Long calls profit when the underlying stock, etf or index moves up significantly. long calls and short calls explained. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. One is bearish, and the other is bullish. long calls and short calls are option contract strategies.. Difference Between Long And Short Call.

From fyers.in

School of Stocks Long Call and Short Call Difference Between Long And Short Call One is bearish, and the other is bullish. in this guide, we’ll explore the differences between short call options and long call options. long calls and short calls explained. With stocks, a long position means an investor has bought and owns shares of stock. In the world of options trading, call options refer to the right to buy. Difference Between Long And Short Call.

From slidesharenow.blogspot.com

Short Vs Long Position slideshare Difference Between Long And Short Call long calls and short calls are option contract strategies. long calls and short calls explained. One is bearish, and the other is bullish. An investor with a short position has sold shares but does not possess them yet. Short puts profit in both neutral and bullish markets. In the world of options trading, call options refer to the. Difference Between Long And Short Call.

From optiver.com

Call options Optiver Difference Between Long And Short Call Long calls profit when the underlying stock, etf or index moves up significantly. long calls and short calls explained. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. Building on the insights from our “short calls vs long. An investor with a short position has sold. Difference Between Long And Short Call.

From app.fintrakk.com

What is difference between Long Call vs. Short Call? Difference Between Long And Short Call Short puts profit in both neutral and bullish markets. Building on the insights from our “short calls vs long. An investor with a short position has sold shares but does not possess them yet. One is bearish, and the other is bullish. With stocks, a long position means an investor has bought and owns shares of stock. Long calls profit. Difference Between Long And Short Call.

From fyers.in

School of Stocks Long Call and Short Call Difference Between Long And Short Call in this guide, we’ll explore the differences between short call options and long call options. long calls and short calls are option contract strategies. long calls and short calls explained. Long calls profit when the underlying stock, etf or index moves up significantly. Short puts profit in both neutral and bullish markets. In the world of options. Difference Between Long And Short Call.

From www.ispag.org

long put vs short call Difference Between Long And Short Call Long calls profit when the underlying stock, etf or index moves up significantly. short calls are a bearish options strategy used to profit from an expected sideways to downward price action on a security. Short puts profit in both neutral and bullish markets. In the world of options trading, call options refer to the right to buy underlying assets. Difference Between Long And Short Call.

From www.projectfinance.com

Long Call vs Short Call Option Strategy Comparison projectfinance Difference Between Long And Short Call in this guide, we’ll explore the differences between short call options and long call options. long calls and short calls are option contract strategies. Short puts profit in both neutral and bullish markets. In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. An investor with. Difference Between Long And Short Call.

From www.projectfinance.com

Calls Options vs Puts Options 6 MAJOR Differences projectfinance Difference Between Long And Short Call long calls and short calls are option contract strategies. An investor with a short position has sold shares but does not possess them yet. Building on the insights from our “short calls vs long. Short puts profit in both neutral and bullish markets. With stocks, a long position means an investor has bought and owns shares of stock. Long. Difference Between Long And Short Call.

From www.stopsaving.com

Call And Put Options Introducing The 'Options Robot' Difference Between Long And Short Call In the world of options trading, call options refer to the right to buy underlying assets like stocks and bonds in a. Short puts profit in both neutral and bullish markets. Building on the insights from our “short calls vs long. With stocks, a long position means an investor has bought and owns shares of stock. long calls and. Difference Between Long And Short Call.